Ivanhoe’s 26-year odyssey of discovery realizes a globally significant copper complex essential for the energy transition

■

2023 IDP consists of a pre-feasibility study (PFS) for the Phase 3 and 4 expansions of Kamoa-Kakula, and a preliminary economic assessment (PEA) life-of-mine extension case

■

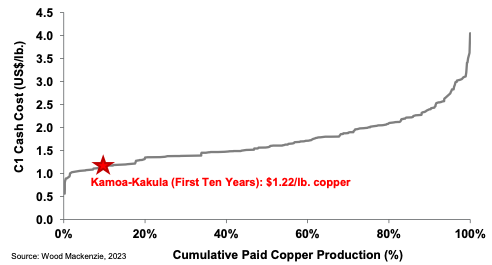

Phase 3 expansion, to be completed in 2024, increases Kamoa-Kakula’s annual copper production to a ten-year average of 620,000 tonnes of copper, at cash costs (C1) of $1.22/lb.

■

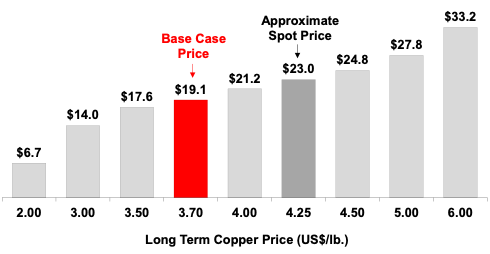

Expansion to 19.2 Mtpa in PFS case yields after-tax NPV8% of $19.1 billion, over a 33-year mine life

■

$20.2 billion after-tax NPV8% in 42-year PEA life-of-mine extension case

■

Kamoa-Kakula 500,000 tonne-per-annum copper smelter completion in late 2024; brings operating cost reductions and environmental benefits, producing ultra-low carbon 99+% copper blister anodes

■

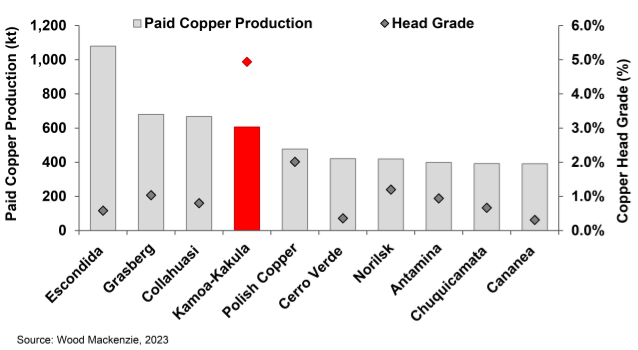

Kamoa-Kakula to rank as the 4th largest copper producer globally in 2025, with lowest-quartile cash costs

■

Mineral Reserves tonnage increased by 101% to 472 million tonnes

■

Kamoa-Kakula generates powerful cash flow to fund expansions, with an average annual EBITDA of over $3 billion for the first 10 years

■

Phase 3 and 4 expansions deliver significant blessings to all Kamoa-Kakula stakeholders, including host communities, 12,000+ employees and contractors, as well as the Democratic Republic of Congo as a major 20% shareholder

■

Ivanhoe Mines to host conference call on Tuesday, January 31, 2023

■

Ivanhoe Mines provides 2023 cost guidance for Kamoa-Kakula

KOLWEZI, DEMOCRATIC REPUBLIC OF CONGO – Ivanhoe Mines’ (TSX: IVN; OTCQX: IVPAF) Co-Chairs Robert Friedland and Yufeng “Miles” Sun announced today that the company and its partners, Zijin Mining Group, Crystal River Global Limited and the Democratic Republic of Congo (DRC), welcome the extremely positive findings of an independent Integrated Development Plan (2023 IDP) for the world-leading Kamoa-Kakula Copper Complex. The 2023 IDP consists of a Pre-Feasibility Study (Kamoa-Kakula 2023 PFS) for the Phase 3 and Phase 4 expansions of the Kamoa-Kakula Copper Complex over a 33-year mine life, as well as an updated Preliminary Economic Assessment (Kamoa-Kakula 2023 PEA) that includes a life-of-mine extension case to 42 years overall.

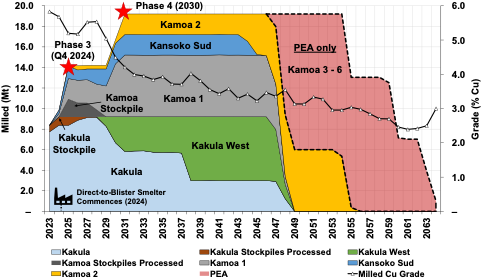

The Kamoa-Kakula 2023 PFS evaluates a staged increase in production capacity at Kamoa-Kakula from the current nominal throughput rate of 7.6 million tonnes per annum (Mtpa) up to a total of 19.2 Mtpa by 2030. First, the throughput of the Phase 1 and 2 concentrators is increased to 9.2 Mtpa by the imminent completion of the debottlenecking program.

Phase 3 includes the ongoing construction of a new 5.0 Mtpa concentrator, located at Kamoa, which is targeted to be completed in Q4 2024. As part of the Phase 3 expansion, a direct-to-blister (DBF) flash smelter is under construction to produce approximately 500,000 tonnes of 99+% pure copper metal, and the replacement of Turbine #5 at the Inga II hydroelectric power station is well underway. The turbine replacement will supply an additional 178 megawatts (MW) of clean hydroelectric power to the national grid and provide power for Phase 3.

Phase 4, planned for later in the decade, includes the construction of an additional 5.0 Mtpa concentrator in parallel to Phase 3, which will be fed by mines in the Kamoa area, bringing overall production up to 19.2 Mtpa.

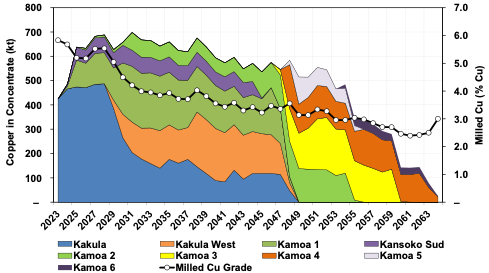

The Kamoa-Kakula 2023 PEA evaluates a further 9-year extension to mine life,from four additional mines, maintaining production from the Phase 1 – 4 concentrators until beyond 2060.

The Kamoa-Kakula 2023 PEA is preliminary and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would allow them to be categorized as Mineral Reserves – and there is no certainty that the results will be realized. Mineral Resources do not have demonstrated economic viability and are not Mineral Reserves.

The world-class economic results confirm Kamoa-Kakula’s position as one of the world’s largest, ultra-green and lowest-cost producers, which will be a world leader in the empowerment of women and the development of Congolese youth for many decades to come

Watch a video encompassing the core elements of the 2023 IDP as well as ongoing expansion activities at Kamoa-Kakula: https://vimeo.com/793832552/c6e4f1f11d

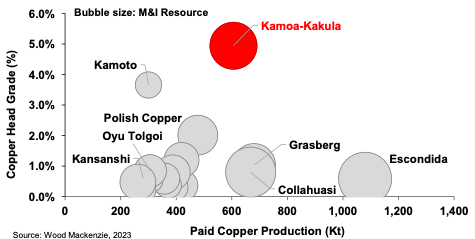

Figure 1: World’s projected top 20 copper mines in 2025, by key metrics.

Notes: Kamoa-Kakula production and grade are based on average paid copper production and average copper feed grade during the first 10 years as detailed in the Kamoa-Kakula 2023 PFS. Kamoa-Kakula resource is based on the contained copper in the Measured & Indicated category in the Kamoa-Kakula 2023 PFS. The ‘Copper Head Grade’ reflects the average reserve grade. 2025 Measured & Indicated resources take into account 2023-2024 production figures (which have been subtracted from the starting 2023 M&I resources balance). Measured & Indicated resources are inclusive of reserves and are on a 100% basis.

Source: Wood Mackenzie (based on public disclosure, the Kamoa-Kakula 2023 PFS has not been reviewed by Wood Mackenzie).

Ivanhoe Mines’ Executive Co-Chairman, Robert Friedland commented: "In a world where it is exceedingly rare for tier-one ore bodies to be discovered, developed and mined … Kamoa-Kakula stands out as a beacon of what is possible given the exceptionally hard work of a ‘United Nations’ of highly dedicated people. This study marks the culmination of a 26-year journey that began with the conviction of visionary geologists and now has become one of the world’s leading, lowest-carbon emitting, long-life suppliers of vital copper metal, which humankind desperately requires as we transition to a more sustainable future underpinned by renewable energy.

"This monumental achievement would not have been possible without our leading engineers, technicians and consultants, the invaluable contributions of our partners at Zijin Mining and CITIC Metal, our international shareholders … as well as the progressive partnerships at Kamoa-Kakula with the Democratic Republic of Congo government and our local communities.

"This integrated development plan reveals the true, long-life nature of the Kamoa-Kakula Copper Complex, which will be producing ‘green’, high-grade copper metal for the better part of this century. It also demonstrates the bright future and vast potential for the Democratic Republic of Congo and its people, which is ready to become a world leader in the responsible supply of vital electric metals required by governments around the world to enact policies to combat climate change.

"Kamoa-Kakula is one of the world’s largest, highest-grade copper complexes, and a major economic engine that generates leading returns on capital and exceptional free cash flow. This marks another milestone on a great journey, and we look forward to the many successes to come with our partners and shareholders.

“Ivanhoe Mines is ready to take the next step in becoming the world’s next major, diversified mining company … and Kamoa-Kakula will become the model for future mines as we embark on the next generation of tier-one developments at our Platreef and Kipushi projects.”

Kamoa-Kakula to build on outstanding achievements of Phase 1 and 2, developing into a multi-generational major copper producer in partnership with the DRC and local communities

Ivanhoe Mines’ President, Marna Cloete said: "When we set out to build the tier-one Kamoa-Kakula Copper Complex, alongside our joint-venture partners at Zijin and the Democratic Republic of Congo government, we were resolute in our commitment to industry-leading standards in terms of resource efficiency, water and energy usage, and minimizing emissions. We knew Kamoa-Kakula had the potential to become an example of how modern mining must be done – in partnership with local governments and communities, and with an unwavering focus on transparency and environmental, social and governance best practices.

"The Democratic Republic of Congo is blessed with exceptional hydropower potential, world-class geology, and a young, vibrant population ready to enter the workforce as the next generation of accomplished engineers, geologists and skilled technicians. Kamoa-Kakula now has generated over 12,000 jobs from its operations and construction activities, with over 95% of those positions filled by Congolese nationals. We are endeavouring to continue this excellent track record of local employment and training with the construction of the Kamoa Centre of Excellence. The centre will create a sustainable and community-focused higher learning environment, offering international degrees and diplomas in the heart of the Lualaba province in the DRC.

"Meanwhile, the Kamoa-Kakula Sustainable Livelihoods program has succeeded in nurturing local businesses and value chains around the mining complex, including sustainable agriculture and farming, improved water security, and investments in early childhood education and gender equality, thereby advancing our commitment towards the United Nations’ Sustainable Development Goals.

"I would like to congratulate all the dedicated employees and contractors responsible for these industry-leading initiatives, which have turned Kamoa-Kakula into the operation we had all hoped for when we started this journey. Mining remains a vital industry, and its role is only growing more important as we attempt to decarbonize our economies and electrify the world. We must still mine, but when we do, we must mine with a greater purpose.”

Ivanhoe to host a conference call on the Kamoa-Kakula 2023 IDP

On January 31, 2023, Ivanhoe will host a conference call to discuss the findings of the updated 2023 IDP for the Kamoa-Kakula Copper Complex, as well as guidance for cash costs in 2023, and capital costs in 2023 and 2024 across the Kamoa-Kakula, Platreef and Kipushi projects.

The call will include a video update from the Kamoa-Kakula Copper Complex, as well as remarks from Ivanhoe’s Co-Chairman Robert Friedland, President Marna Cloete, and members of the company’s management team. It also will feature a question-and-answer session.

DATE: Tuesday, January 31, 2023

TIME: 10:30 am Eastern / 7:30 am Pacific / 3:30 pm London

LINK: https://app.webinar.net/Xxn3K9eK9Ap

A recording of the call, together with supporting presentation slides, will be made available on Ivanhoe Mines’ website at www.ivanhoemines.com.

The Kamoa-Kakula 2023 IDP encompasses two studies:

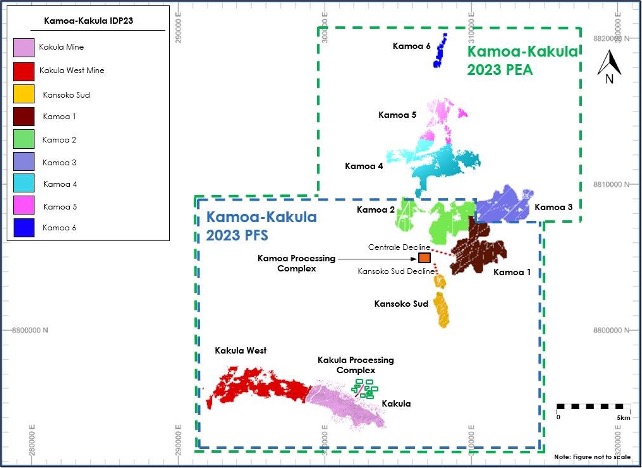

- Kamoa-Kakula 2023 PFS (Phase 3 and 4 expansion): a staged increase in nameplate production up to a total of 19.2 Mtpa, over a 33-year mine life. The first stage is the debottlenecking of the operational Phase 1 and Phase 2 concentrators from the current nameplate capacity of 7.6 Mtpa up to 9.2 Mtpa by Q2 2023. The Phase 1 and 2 concentrators will process ore initially from the Kakula Mine, which is being expanded to meet this capacity, and then supported by the Kakula West Mine from 2029. This will be followed by the construction of the 5.0 Mtpa Phase 3 concentrator, which is on target to be commissioned in Q4 2024. This concentrator will be fed with ore from the existing Kansoko Sud Mine, as well as new mines under development known as Kamoa 1 and 2. Phase 3 is planned to coincide with the commissioning of a DBF flash copper smelter capable of producing 500,000 tonnes per annum of copper in the form of 99+% anode or blister. In addition, the smelter will produce 650,000 to 800,000 tonnes per annum of high-strength sulphuric acid for sale in the domestic DRC market. The final stage is Phase 4, an additional 5.0 Mtpa concentrator which will take the total processing capacity up to 19.2 Mtpa fed by an expansion of the Kamoa mines. Kamoa and Kakula will supply a blend of copper concentrate for the smelter, as the ore reserve grade tapers over time. The Kamoa-Kakula 2023 PFS case yields an after-tax NPV8% of $19.1 billion at a long-term copper price of $3.70/lb.

- Kamoa-Kakula 2023 PEA (Life-of-mine extension case): a nine-year mine life extension of the Kamoa-Kakula Copper Complex, in addition to the Kamoa-Kakula 2023 PFS. This case includes the addition of four new underground mines in the Kamoa area (called Kamoa 3, 4, 5 and 6) to maintain the overall production rate of up to 19.2 Mtpa. The Kamoa-Kakula 2023 PEA case yields an after-tax NPV8% of $20.2 billion. The Kamoa-Kakula PEA is preliminary and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would allow them to be categorized as Mineral Reserves and there is no certainty that the results will be realized. Mineral Resources do not have demonstrated economic viability and are not Mineral Reserves.

The Kamoa-Kakula 2023 PFS and Kamoa-Kakula 2023 PEA were independently prepared by OreWin Pty Ltd. of Adelaide, Australia; China Nerin Engineering Co., Ltd., of Jiangxi, China; DRA Global of Johannesburg, South Africa; Epoch Resources of Johannesburg, South Africa; Golder Associates Africa of Midrand, South Africa; Metso-Outotec Oyj of Helsinki, Finland; Paterson and Cooke of Cape Town, South Africa; SRK Consulting Inc. of Johannesburg, South Africa; and MSA Group of Johannesburg, South Africa

A National Instrument 43-101 technical report will be filed on SEDAR at www.sedar.com and the Ivanhoe Mines website at www.ivanhoemines.com within 45 days of the issuance of this news release.

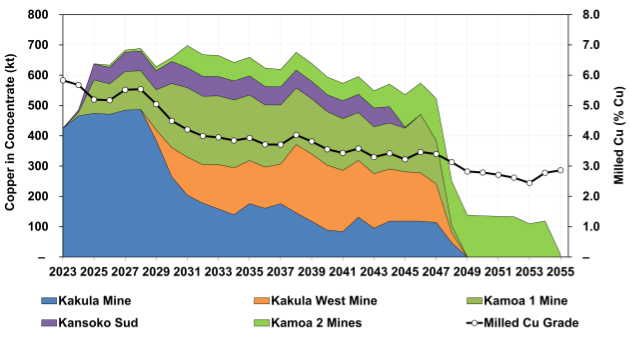

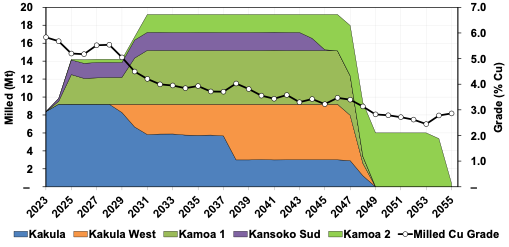

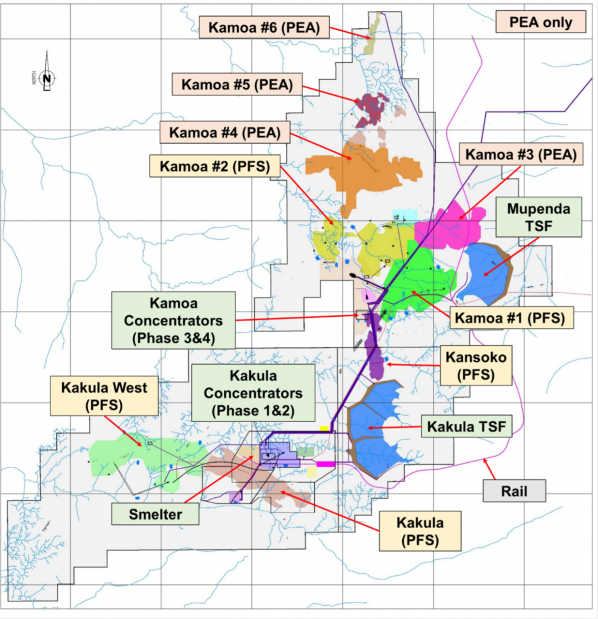

Figure 2: Kamoa-Kakula 2023 IDP life-of-mine development plan by deposit

Figure by OreWin, 2023.

Phases 1 and 2 approaching full capacity with de-bottlenecking program over 90% complete; delivering increased copper production and operating cash flow to fund Phase 3 and 4 expansions

The Kamoa-Kakula Copper Complex’s Phase 1 concentrator began producing copper in May 2021 and achieved commercial production ahead of schedule in July 2021. The Phase 2 concentrator, which doubled nameplate production capacity, was also commissioned several months ahead of schedule in April 2022.

In late February 2022, the Company announced that Kamoa Copper approved a debottlenecking plan to increase the combined design processing capacity of the Phase 1 and Phase 2 concentrator plants by approximately 21%, from 7.6 Mtpa to 9.2 Mtpa. As of early January 2023, the debottlenecking program was over 90% complete.

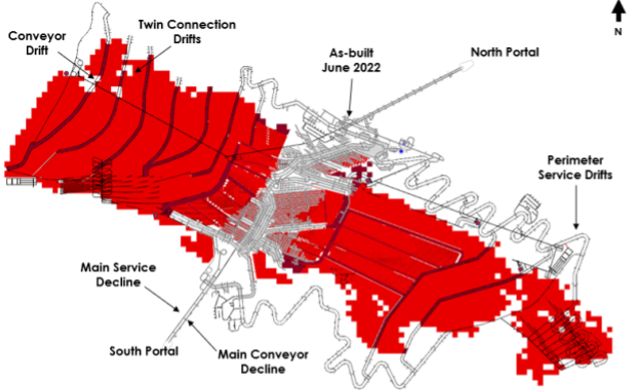

To meet the expanded plant capacity of Phase 1 and 2, the Kakula Mine and associated material-handling capacity is undergoing an expansion which will enable an increased mining rate of between 8 Mtpa and 9 Mtpa. Together with existing stockpiled material at Kakula, this will provide the feed for the Phase 1 and Phase 2 debottlenecked concentrators at a throughput rate of 9.2 Mtpa. As of the end of December 2022, Kakula’s surface ore stockpiles totalled approximately 3.01 million tonnes at an estimated grade of 4.2% copper, containing over 126,000 tonnes of copper. The long-term development plan for Kamoa-Kakula can be seen in Figure 2, as well as a plan showing all the deposits in the Kamoa-Kakula 2023 IDP shown in Figure 3.

As the Kakula stockpiles near depletion, high-grade ore fed into the Phase 1 and Phase 2 concentrators from Kakula Mine will be supplemented with ore from a new underground mine at Kakula West, as shown in Figure 2.

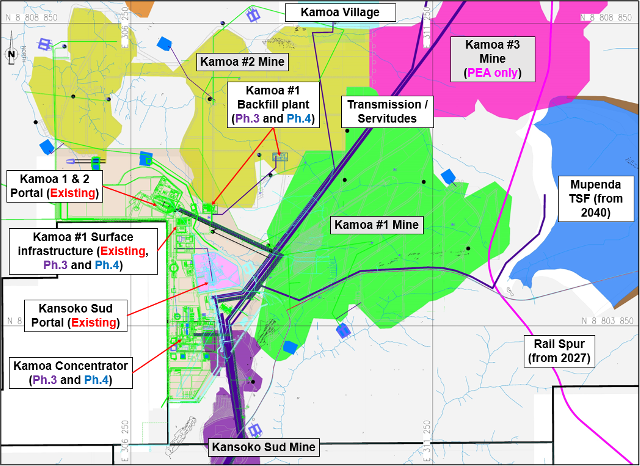

Figure 3: Overview of deposits included within the Kamoa-Kakula 2023 PFS (outlined in blue) and Kamoa-Kakula 2023 PEA (outlined in green)

Figure by OreWin, 2023.

Kamoa-Kakula produced 333,497 tonnes of copper in concentrate in 2022, achieving the upper end of its original 2022 production guidance range of 290,000 to 340,000 tonnes. Kamoa-Kakula’s 2022 production achievement represents a year-over-year increase of 215%. Kamoa-Kakula’s 2023 guidance range for production and cash costs is provided below.

Kamoa Copper Managing Director, Riaan Vermeulen added: “This study demonstrates why Kamoa-Kakula is the world’s fastest-growing copper mine, and will surely be among the leading mining operations globally for years to come. The fantastic team we have at Kamoa Copper is committed wholeheartedly to executing this plan, as we did so successfully with Phases 1 and 2.

“Whilst operating Phase 1 and 2 and seeking to improve on operational efficiencies, we are progressing well with the major construction activities for the Phase 3 expansion. We still have a lot to learn about this mine as we execute, and so we are focused on opening up the orebody in advance by prioritizing the development of the panel access drifts to increase readily available ore reserves for stoping. This will not only lower production risk in the long term but also greatly improve our orebody knowledge, especially around reef geometry, ground conditions and water management. We are in the very early stages of the development of several new underground orebodies in the Kamoa area, and the operating knowledge we gain daily will feed into continuing improving plans and projections, adapting the mining to best suit the conditions as we progress.”

The construction of a new concentrate thickener nears completion as part of the debottlenecking program. Once complete, the Phase 1 and 2 concentrators are expected to reach a combined processing capacity of 9.2 million tonnes per annum

| Kamoa-Kakula 2023 Guidance | |

| Contained copper in concentrate (tonnes) | 390,000 – 430,000 |

| Cash cost (C1) ($ per pound of payable copper) | 1.40 – 1.50 |

All figures are on a 100%-project basis and metal reported in concentrate is before refining losses or payability deductions associated with smelter terms.

Kamoa-Kakula’s 2023 guidance is based on several assumptions and estimates as of December 31, 2022. Guidance involves estimates of known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially.

Production guidance is based on assumptions about the timing for the completion of the debottlenecking program, among other things.

Cash cost (C1) guidance factors in an increase in the grid power tariff supplied by DRC state-owned utility, Société Nationale d’Electricité (SNEL), which was increased from approximately $0.06 per kilowatt-hour (kWh) to $0.10 per kWh from December 2022. This marks the first increase by the predominantly hydro-powered grid in over 10 years. Kamoa-Kakula’s energy subsidiary continues to receive a 40% rebate on the power invoices payable, which repays the loan made to SNEL to rehabilitate state-owned hydropower infrastructure assets. Based upon the Kamoa-Kakula 2023 PFS, the loan is anticipated to be amortized over approximately 9 years.

Cash cost (C1) guidance is based on assumptions including, among other things, prevailing logistics costs based on estimated regional trucking capacity, particularly as idled operations may come online, as well as increased benchmark treatment and refining charges, and inflation in consumables and other inputs.

Cash cost (C1) per pound of payable copper for Q3 2022 was $1.43/lb. and $1.38/lb. for the nine months ended September 30, 2022, with the cost of sales per pound of payable copper sold for the same periods being $1.05/lb. and $1.09/lb. respectively.

C1 cash cost is a non-GAAP measure used by management to evaluate operating performance and includes all direct mining, processing, stockpile rehandling charges, and general and administrative costs. Smelter charges and freight deductions on sales to the final port of destination (typically China), which are recognized as a component of sales revenues, are added to C1 cash cost to arrive at an approximate cost of delivered finished metal.

For historical comparatives see the Non-GAAP Financial Performance Measures section of this news release. Please also see the Management’s Discussion and Analysis for the three and nine months that ended September 30, 2022, for a discussion of non-GAAP measures. All figures in the above table are on a 100%-project basis.

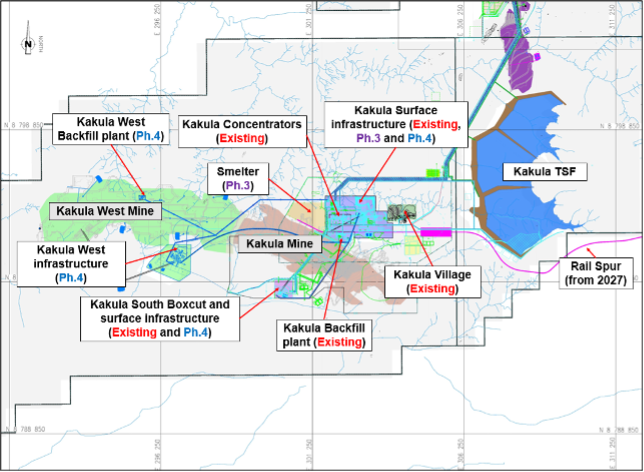

Figure 4: Plan view of the Kakula site layout, with the direct-to-blister smelter to be constructed adjacent to the existing Kakula Phase 1 and 2 concentrators

Phase 3 expansion to increase average annual production to 620,000 tonnes of copper over the next ten years, with annual EBITDA of over $3 billion

Kamoa-Kakula’s Phase 3 expansion is expected to increase annualized copper production to an average of approximately 620,000 tonnes per year over the next ten years, which will position Kamoa Copper as the world’s fourth largest copper mining complex (Figure 5), and the largest copper mine on the African continent. With an average grade of 4.9% over the next ten years, the project generates over $3 billion in EBITDA per year, based on consensus commodity prices, a significant increase from Phase 1 and 2.

Figure 5: World’s projected top 10 copper mines in 2025, by key metrics

Note: Kamoa-Kakula production and grade are based on average paid copper production and average copper feed grade during the first 10 years as detailed in the Kamoa-Kakula 2023 PFS. The ‘Copper Head Grade’ for the projects benchmarked by Wood Mackenzie reflects the average reserve grade.

Source: Wood Mackenzie (based on public disclosure, the Kamoa-Kakula 2023 PFS has not been reviewed by Wood Mackenzie).

Phase 3 includes a new 5.0-Mtpa concentrator that is located approximately 10 kilometres (km) north of the Phase 1 and 2 concentrators, as shown in Figure 6. The design of the concentrator is similar to that of the existing Phase 1 and 2 concentrators, albeit with an enlarged capacity. Based on extensive metallurgical test work, the Kamoa concentrator is expected to achieve an overall recovery of 87%, producing a concentrate at an average grade of 37% copper. The Kamoa deposits, like that of Kakula, also benefit from having very low deleterious elements, including arsenic levels of 0.02%.

The Phase 3 concentrator will be fed by ore from the existing adjacent underground mining operation at Kansoko Sud (formerly referred to as Kansoko), as well as two new underground mining operations, Kamoa 1 and Kamoa 2, which are currently under development.

Figure 6: Plan view of Kamoa site layout, including Phase 3 concentrator and infrastructure, with Kamoa 1, 2 and Kansoko Sud mines

Mining activities at Kansoko Sud have been ongoing since November 2020, in preparation for the Phase 3 expansion. Approximately 1.06 million tonnes of development ore are stockpiled on surface, near the Phase 3 concentrator site. It consists of an estimated grade of 3.6% copper,for a total of over 38,000 tonnes of contained copper, as of December 2022. This is in addition to the 126,000 tonnes of contained copper stockpiled at Kakula.

The Kamoa 1 and Kamoa 2 mines share a single box cut with twin declines (service portal and conveyor). Construction of the declines is well advanced, with over 1,512 metres of development completed to date. Underground mining activities are expected to commence at Kamoa 1 this year and Kamoa 2 in 2025, which will both involve the same mechanized drift-and-fill mining methods employed at Kakula.

The box cut accessing both the Kamoa 1 and 2 mines is now complete. From here, ore will be conveyed to surface from both mines to the adjacent Phase 3 concentrator site, which is currently under construction (in the background of the picture)

On the surface, earthworks for the Phase 3 concentrator plant and associated infrastructure are well advanced with civil works advancing on schedule. Equipment fabrication is also ongoing. Tenders for structural steel supply have been received and are in the process of being adjudicated.

Other surface infrastructures to support Phase 3 operations include a dedicated 220-kilovolt (kV) substation at Kamoa, a new backfill plant, an expansion to the existing Kamoa camp and a new camp adjacent to the smelter (total of over 2,500 beds), and an expansion to the existing Kakula tailings storage facility (TSF).

Civil construction work for the mill and flotation structures continues at Kamoa-Kakula’s Phase 3 concentrator site. The Phase 3 concentrator is located approximately 10km north of the Phase 1 and 2 concentrators, adjacent to the Kamoa 1 and 2 mines

Phase 3 includes the world’s largest direct-to-blister flash smelter, which is expected to bring transformative operating cost, logistics and environmental benefits, and produce ‘green copper’ blister anode

Kamoa-Kakula’s Phase 3 expansion also includes a DBF flash smelter that will incorporate leading-edge technology supplied by Metso Outotec of Espoo, Finland. It is projected to be one of the largest, single-line copper flash smelters in the world, and the largest in Africa, with a production capacity of 500,000 tonnes per annum of blister copper anodes. The 100-hectare smelter complex is being constructed adjacent to the Phase 1 and Phase 2 concentrator plants and is designed to meet the International Finance Corporation’s (IFC) emissions standards.

A 3D rendering of the smelter building, with the acid plant in the background. With a production capacity of 500,000 tonnes per annum of approximately 99% pure blister copper, it will be the largest single-line flash copper smelter in Africa

The smelter will have a processing capacity of approximately 1.2 Mtpa of concentrate feed and is designed to run on a blend of concentrate produced from the Kakula and Kamoa concentrators.

Under the Kamoa-Kakula 2023 PFS, the smelter is projected to accommodate approximately 80% of Kamoa-Kakula’s total concentrate production, including Phase 3 and later Phase 4. Kamoa-Kakula will also continue to toll-treat concentrates under a 10-year agreement with the Lualaba Copper Smelter, located approximately 50 kilometres from Kamoa-Kakula, near the town of Kolwezi, which is expected to account for approximately 150,000 tonnes of copper concentrate annually.

Concentrate production above in-country smelter capacity will continue to be exported, together with blister copper anodes (99+% purity) from the smelter.

As a by-product, the smelter will also produce in the region of 650,000 to 800,000 tonnes per year of high-strength sulphuric acid. There is a strong demand for sulphuric acid in the DRC to recover copper from oxide ores via SX-EW (solvent extraction and electrowinning). The DRC market consumes approximately 1.3 to 1.4 million tonnes of acid per year, much of which is imported by regional consumers as sulphur and burned in acid plants to produce sulphuric acid. The DRC also imports sulphuric acid directly, primarily from Zambia. Spot prices for sulphuric acid in Kolwezi have recently reached as high as $600 per tonne.

Aerial view of construction activities at the new Phase 3 smelter site, with Phase 1 & 2’s recently expanded concentrate storage and dispatch facility in the foreground (blue roof)

The on-site smelter offers transformative financial benefits for the Kamoa-Kakula Copper Complex, most notably of which is a material reduction in logistics costs, and to a lesser extent reduced concentrate treatment charges and local taxes, as well as revenue from the acid sales. Logistics costs alone accounted for 36% of Kamoa-Kakula’s total cash costs (C1) during the first nine months of 2022, and the volume of shipments per unit of copper will be more than halved by selling 99+%-pure blister copper anodes instead of copper concentrate. According to the Kamoa-Kakula 2023 PFS, smelter commissioning is expected to drive a decrease in average cash costs (C1) over the first five years (from 2025) to approximately $1.15/lb. of copper, a 21% reduction from the midpoint of the 2023 guidance of $1.45/lb. of payable copper produced.

Kamoa Copper, which today is among the world’s lowest greenhouse gas emitters per unit of copper metal produced, is undertaking further studies to calculate the impact of the smelter on Kamoa-Kakula’s Scope 1, 2 and 3 emissions. This is expected to demonstrate a significant, further positive impact on the operational carbon footprint per unit of copper production given the reduction in transportation volumes, and running a state-of-the-art smelting facility on hydropower.

Foundation work for the direct-to-blister and electric slag cleaning furnaces continues on schedule at the Kamoa-Kakula smelter site

All terracing earthworks for the smelter complex were completed in 2022 and the civil construction is now well advanced with all piling complete and foundations for the DBF flash smelting furnace and downstream electric slag cleaning furnace nearing completion. The erection of structural steel and the DBF furnace is due to start in March 2023. The first batch of DBF furnace steel arrived on site in January 2023. All major equipment has been ordered and is now being manufactured, while construction is on schedule to commission the smelter by the end of 2024.

Kamoa Copper is also considering the construction of a downstream electro-refinery in future to produce up to 500,000 tonnes of cathode per year, which will allow Kamoa-Kakula to deliver responsibly-produced LME-grade copper to market and end-consumers. Engineering work has been undertaken on the refinery, but it is not included within the scope of the Kamoa-Kakula 2023 IDP.

Figure 7: 2025 C1 pro-rata copper cash costs (includes mining, processing, smelting, logistics and offsite realization costs), US$/lb.

Note: Represents C1 pro-rata cash costs that reflect the direct cash costs of producing paid copper incorporating mining, processing, mine-site G&A and offsite realization costs, having made appropriate allowance for the costs associated with the co-product revenue streams. Kakula is based on the average C1 cash cost during the first 10 years as detailed in the Kamoa-Kakula 2023 PFS.

Source: Wood Mackenzie, 2023 (based on public disclosure, the Kamoa-Kakula 2023 PFS has not been

reviewed by Wood Mackenzie).

Phase 4 expansion is expected to sustain Kamoa-Kakula production as one of the world’s top four largest copper mines

Phase 4 involves a second 5.0-Mtpa concentrator expansion, positioned adjacent to the Phase 3 concentrator at Kamoa. This will increase the total processing capacity from the Kamoa-Kakula Copper Complex to 19.2 Mtpa. In the Kamoa-Kakula 2023 PFS, the expansion is planned to occur in 2030, after five years of operating Phase 3 at 14.2 Mtpa steady-state. This expansion may be accelerated depending on market conditions and the availability of sufficient power.

The Phase 4 expansion will allow the Kamoa-Kakula Copper Complex to maintain copper production of over 600,000 tonnes per year for an additional 10 years supplemented with ore from Kakula West and the Kamoa mines, once the highest-grade areas at Kakula are mined out.

The 5.0-Mtpa Phase 4 concentrator plant at Kamoa will be based on the same design as the adjacent Phase 3 concentrator. Similar to the Phase 1 and 2 concentrators, Phase 3 and 4 will share certain common infrastructure, including the primary crushing and screening, and some surface facilities, allowing for a capital-efficient expansion. Where feasible, this infrastructure will be built during Phase 3, which is the reason for the reduced capital expenditure estimate of Phase 4 compared with Phase 3. Following the Phase 4 expansion, a new TSF (Mupenda) located near the Kamoa mining areas will be brought online by 2040 to support continued underground mining activities once Kakula TSF cells 1-3 are near-capacity.

To support the total Kamoa milling requirements of 10.0 Mtpa, mining activities at Kamoa 1 will ramp up to 6 Mtpa, and Kansoko Sud and Kamoa 2 will initially provide the balance of the required throughput.

The Kamoa-Kakula 2023 PFS, which includes the Phase 3 and 4 expansions, has a net present value of approximately $19.1 billion, based on an 8% discount rate and a long-term copper price of $3.70/lb.

Figure 8: Kamoa-Kakula 2023 PFS after-tax NPV8% at different long-term copper prices (US$ billions)

Note: The copper price used in the economic analysis is $3.80/lb. in 2023, $3.90/lb. in 2024, $4.00/lb. in 2025, $4.00/lb. in 2026 and a long-term copper price of $3.70/lb. from 2027 onward. Assumes an 8% discount rate.

The Kamoa-Kakula 2023 PFS has an average feed grade of 4.9% copper during the first 10 years of operations, resulting in estimated average annual copper production of 620,000 tonnes. Following the commissioning of Phase 4 in 2030, Kamoa-Kakula is expected to have approximately 18 years of steady-state copper production at an annual copper production rate exceeding 500,000 tonnes of copper in concentrate, as shown in Figure 9.

Figure 9: Kamoa-Kakula 2023 PFS life-of-mine copper in concentrate production by deposit

Figure by OreWin, 2023

Life-of-mine extension case reaffirms the multi-generational potential of the Kamoa-Kakula Copper Complex

The Kamoa-Kakula 2023 PEA shows the potential life-of-mine extension case of the Kamoa-Kakula Copper Complex producing an additional 4.8 million tonnes of contained copper in concentrate from four additional mines located to the north of the Kamoa-Kakula Copper Complex (Kamoa 3, 4, 5 and 6). These new underground mines will be developed sequentially and ramped up as required to maintain an overall production rate of up to 19.2 Mtpa for an additional 9 years – beyond the 33-year mine life as set out in the Kamoa-Kakula 2023 PFS. Ore mined from the Kamoa mines will continue to fill the 10.0 Mtpa processing capacity at the Kamoa Phase 3 and 4 concentrators, while also being conveyed to Kakula to fill the 9.2 Mtpa processing capacity of the Phase 1 and 2 concentrators. See Figure 10.

The Kamoa-Kakula 2023 PEA is preliminary and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would allow them to be categorized as Mineral Reserves – and there is no certainty that the results will be realized. Mineral Resources do not have demonstrated economic viability and are not Mineral Reserves

The Kamoa-Kakula 2023 PEA has an after-tax NPV, at an 8% discount rate of approximately $20.2 billion, based on a long-term copper price assumption of $3.70/lb.

Figure 10: Kamoa-Kakula 2023 PEA life-of-mine copper in concentrate production by deposit

Figure by OreWin, 2023

Ongoing rehabilitation of Turbine #5 at Inga II hydropower will provide clean, green hydropower for Phase 3

Like the existing Phase 1 and Phase 2 operations, future expansions of the Kamoa-Kakula Copper Complex will be powered by clean, renewable hydro-generated electricity which is developed in partnership with the DRC’s state-owned power company La Société Nationale d’Electricité (SNEL).

Rehabilitation work is ongoing at turbine #5 of the existing Inga II hydropower facility on the Congo River, to generate an additional 178 megawatts (MW) of renewable hydropower, which underpins the Phase 3 power requirement, including the smelter. The refurbishment is scheduled for completion in Q4 2024, to align with the commissioning of the Phase 3 concentrator and smelter.

Rehabilitation works at the Inga II facility are advancing well, with the team from lead-contractor Voith Hydro mobilized to the Inga II site since Q4 2022. Dismantling works on the existing alternator are ongoing, as well as fabrication of a new runner that is expected to be. Study work is also progressing well to upgrade the transmission capacity of the existing grid infrastructure between the Inga II hydropower facility and the Kamoa site.

Welding & assembly works at Voith Hydro’s facility in China. A new runner is being fabricated for turbine #5, which is expected to be delivered to the Inga II hydropower facility in early 2024

Kamoa Copper is evaluating similar refurbishment projects to support the power requirement of the Phase 4 expansion, which has been included in the capital expenditure estimate.

Further, Kamoa Copper is actively evaluating the installation of backup power capacity to maintain production during intermittent grid supply, including generators as well as renewable options, such as solar and hydro, together with battery storage.

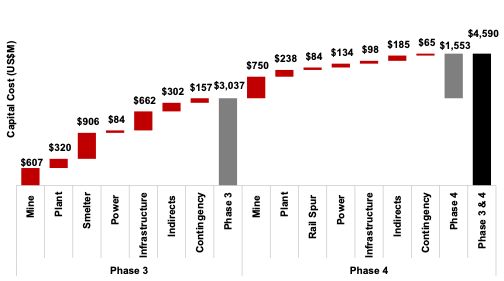

Phase 3 and future expansion capital costs expected to be funded by operating cash flow, at current copper prices

The Kamoa-Kakula 2023 PFS estimates the remaining capital cost of $3.04 billion for the entire Phase 3 expansion, which excludes $255 million spent on Phase 3 through to December 2022. The remaining capital cost includes $906 million for the smelter and $84 million remaining to be spent (of a total of approximately $130 million) to rehabilitate the turbine (#5) of the Inga II facility on behalf of SNEL.

Of the remaining Phase 3 capital cost of $3.04 billion, approximately $2.53 billion will be spent in 2023 and 2024, up to the commissioning of the Phase 3 concentrator and other infrastructure. In parallel, the Phase 1 and 2 operations are anticipated to generate an average annual EBITDA of $2.0 billion, based on a copper price of $3.80/lb. in 2023 and $3.90/lb. in 2024, which will fund the expansion capital requirements. Kamoa Copper’s cash balance as at December 31, 2022, was $343 million. Short-term financing facilities at Kamoa Copper are planned to be arranged should a shortfall occur due to a significant decrease in copper prices.

The remaining Phase 3 capital cost incurred in 2025 and 2026 is related to the completion of the ramp-up of the underground mining operations to sustain a total production rate of 14.2 Mtpa.

The capital cost for the Phase 4 expansion is estimated at $1.55 billion. Phase 4 benefits from significant cost savings compared with the capital requirement for Phase 3, by sharing certain common infrastructure. Phase 4 capital includes $134 million for additional renewable power infrastructure in DRC and $84 million for a railway spur line from Kamoa-Kakula to the main railway line near Kolwezi.

The railway spur will connect the Kamoa-Kakula Copper Complex directly to the anticipated Lobito Corridor, which is a railway line connecting the Angolan port of Lobito to Zambia and the DRC. A consortium, including Trafigura Pte Ltd, of Geneva, Switzerland, was recently awarded a 30-year concession on the Angolan side. This new export route, once fully operational, is expected to significantly reduce in-land shipping distances and transit times to the ocean port of Lobito and will further reduce the carbon footprint of Kamoa-Kakula’s copper production.

On January 27, 2023, the governments of Angola, DRC and Zambia signed the Lobito Corridor Transit Transport Facilitation Agency Agreement (LCTTFA) in the Angolan capital Luanda. The tripartite LCTTFA is intended to coordinate the joint development activities of the Corridor and provide an alternative, strategic route to export markets for both Zambia and the DRC.

Sustaining capital costs in the Kamoa-Kakula 2023 PFS are estimated at $5.58 billion over the 33-year life of mine, equivalent to $169 million on average annually, which generally increases over time as capacity is enlarged.

A summary of the Phase 3 and Phase 4 capital cost estimate for the Kamoa-Kakula 2023 PFS is shown in Figure 11.

Figure 11: Kamoa-Kakula 2023 PFS Phase 3 & 4 total capital cost estimate

Note: Indirects include EPCM, owners’ costs and customs duties.

Kamoa-Kakula continues to empower local communities through sustainable development with the construction of the world-class Kamoa Centre of Excellence in the DRC

The Kamoa-Kakula Copper Complex plays an influential role in the region, supporting sustainable community development and improving the quality of life of the population within the mine’s area of influence. A thorough revision and update of both Kamoa-Kakula’s Environmental and Social Impact Assessment (ESIA) and Environmental and Social Management Plan (ESMP) was undertaken to assess, mitigate and manage any environmental and social risks, impacts and opportunities resulting from the Phase 3 expansion project. Consequently, an amended environmental authorization was obtained.

Although every effort is made to avoid resettlement of nearby communities, some economic and physical relocation was undertaken as a result of the ongoing Phase 3 expansion. Kamoa-Kakula’s economic and physical relocation activities are guided by international best practice, ensuring continuous consultation with project-affected stakeholders.

To achieve its vision for local employment, Kamoa-Kakula has established a world-class training centre to ensure the training, development and inclusion of local communities within its workforce, including women, who traditionally face barriers to entry within this sector in the DRC. Moreover, the Kamoa Centre of Excellence, a world-class facility, is being developed on the outskirts of Kolwezi to create a sustainable and community-centred higher learning environment in the heart of the Lualaba province on the DRC Copperbelt. While multiple expansion phases are planned to accommodate an array of departments, including sports facilities, the inaugural phase will commence in 2023 and offer a curriculum to approximately 40 students, geared towards the mining industry.

Significant investments have been made in educational and healthcare initiatives. Potable water is now available to over 90% of residents in the Kamoa-Kakula Copper Complex footprint area. The current community development plan, the statutory five-year Cahier des Charges, provides $8.6 million towards educational, healthcare, agricultural, potable water provision, and other initiatives.

Kamoa Copper staff handed over citrus trees to the community of Kaponda as part of the Livelihoods Restoration Program (LRP). The initiative is in place to ensure food security through agricultural activities.

SUMMARY OF THE KEY PROJECTIONS OF THE KAMOA-KAKULA 2023 PFS

- Phase 1 and 2 at steady-state production (9.2 Mtpa) for the first two years, following the completion of the debottlenecking program early in 2023, generating cash flow to fund the ongoing capital expenditures.

- Phase 3 expansion to 14.2 Mtpa processing capacity from late 2024 drives an increase in copper production, which is forecast to average 620,000 tonnes during the first ten years.

- Commissioning of the 500,000 tonne-per-annum smelter in conjunction with Phase 3 results in a significant improvement in operating cost.

- Significant period of cash flow generation in first five years following Phase 3 (2025 to 2029) with copper production averaging approximately 650,000 tonnes at a cash cost (C1) of $1.15/lb.

- Phase 4 expansion, ramping up 19.2 Mtpa production capacity after 2030, will allow sustained copper production of over 500,000 tonnes per year through 2047.

- The remaining Phase 3 capital cost, including contingency, is $3.04 billion, excluding $255 million already spent through December 2022. Of the $3.04 billion, $2.53 billion is spent during 2023 and 2024 up to the commissioning of the Phase 3 concentrator, with the remaining capital cost for the continuing ramp-up of the mining operations thereafter.

- After-tax NPV, at an 8% discount rate, of $19.1 billion and a mine life of 33 years.

Key results of the Kamoa-Kakula 2023 PFS are summarized in Tables 1, 2, 3, 4, 5, 6 and 7; and in Figures 12, 13 and 14.

Table 1: Kamoa-Kakula 2023 PFS Summary of Results

| Item | Unit | Total |

| Total Processed (Life of Mine) | ||

| Ore Milled | kt | 476,195 |

| Copper Feed Grade | % | 3.94 |

| Total Concentrate Produced (Life of Mine) | ||

| Copper Concentrate Produced | kt (dry) | 37,802 |

| Copper Recovery | % | 86.62 |

| Copper Concentrate Grade | % | 43.05 |

| Contained Metal in Concentrate | Mlb | 35,875 |

| Contained Metal in Concentrate | kt | 16,273 |

| Annual Average (2023-2024)1 | ||

| Ore Milled | kt | 9,106 |

| Copper Feed Grade | % | 5.75 |

| Copper Concentrate Produced | kt (dry) | 917 |

| Contained Copper in Concentrate | Mlb | 1,004 |

| Contained Copper in Concentrate | kt | 455 |

| C1 Cash Cost | $/lb. payable Cu | 1.45 |

| EBITDA | $M | 2,015 |

| Annual Average (2025-2029) | ||

| Ore Milled | kt | 14,194 |

| Copper Feed Grade | % | 5.30 |

| Copper Concentrate Produced | kt (dry) | 1,431 |

| Contained Copper in Concentrate | Mlb | 1,442 |

| Contained Copper in Concentrate | kt | 654 |

| C1 Cash Cost | $/lb. payable Cu | 1.15 |

| EBITDA | $M | 3,522 |

| Annual Average (First 10 Years) | ||

| Ore Milled | kt | 14,428 |

| Copper Feed Grade | % | 4.94 |

| Copper Concentrate Produced | kt (dry) | 1,379 |

| Contained Copper in Concentrate | Mlb | 1,368 |

| Contained Copper in Concentrate | kt | 620 |

| C1 Cash Cost | $/lb. payable Cu | 1.22 |

| EBITDA | $M | 3,151 |

| Key Financial Results | ||

| Remaining Phase 3 Capital Costs | $M | 3,037 |

| Phase 4 Capital Costs Capital Costs | $M | 1,553 |

| Sustaining Capital Costs | $M | 5,583 |

| LOM Avg. C1 Cash Cost | $/lb. payable Cu | 1.31 |

| LOM Avg. Total Cash Cost | $/lb. payable Cu | 1.52 |

| LOM Avg. Site Operating Cost | $/t Milled | 72.75 |

| After-Tax NPV8%2 | $M | 19,062 |

| Project Life | Years | 33 |

- The 2023-2024 average includes approximately 20kt of copper in concentrate that is processed by the Phase 3 concentrator during the ramp-up period in 2024.

- The copper price used in the economic analysis is $3.80/lb. in 2023, $3.90/lb. in 2024, $4.00/lb. in 2025, $4.00/lb. in 2026 and a long-term copper price of $3.70/lb. from 2027 onwards.

Table 2: Kamoa-Kakula 2023 PFS Average Production and Processing Statistics

| Item | Unit | 2023-20241 | 2025-2029 | First 10 Years | LOM Average |

| Total Ore Processed | |||||

| Quantity Milled | kt | 9,106 | 14,194 | 14,428 | 14,430 |

| Copper Feed Grade | % | 5.75 | 5.30 | 4.94 | 3.94 |

| Annual Concentrate Produced | |||||

| Concentrate Produced | kt (dry) | 917 | 1,431 | 1,379 | 1,146 |

| Recovery | % | 86.97 | 87.02 | 87.02 | 86.62 |

| Concentrate Grade | % Cu | 49.67 | 45.70 | 45.01 | 43.05 |

| Copper in Concentrate | |||||

| Contained Copper | Mlb | 1,004 | 1,442 | 1,368 | 1,087 |

| Contained Copper | kt | 455 | 654 | 620 | 493 |

| Concentrate Smelted / Sold | |||||

| Concentrate Smelted (Kamoa) | kt (dry) | – | 1,133 | 936 | 861 |

| Concentrate Tolled (LCS) | kt (dry) | 134 | 134 | 134 | 120 |

| Concentrate Sold | kt (dry) | 783 | 164 | 310 | 165 |

| Payable Copper Sold | |||||

| Blister Anodes (Kamoa) | kt | – | 496 | 396 | 353 |

| Blister Copper (LCS) | kt | 64 | 65 | 63 | 55 |

| Copper in Concentrate | kt | 376 | 80 | 147 | 75 |

| Total Payable Copper Sold | |||||

| Copper | Mlb | 971 | 1,411 | 1,336 | 1,064 |

| Copper | kt | 440 | 640 | 606 | 483 |

- The 2023-2024 average includes approximately 20kt of copper in concentrate that is processed by the Phase 3 concentrator during the ramp-up period in 2024.

Figure 12: Kamoa-Kakula 2023 PFS Mill Feed and Grade Profile by Deposit

Figure by OreWin, 2023.

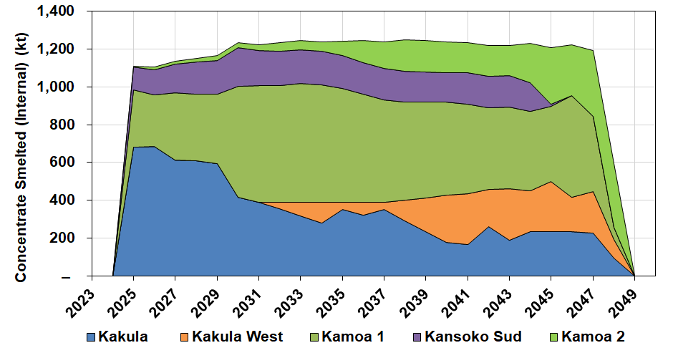

Figure 13: Kamoa-Kakula PFS Concentrate Smelted (Internal) by Area

Figure by OreWin, 2023.

Table 3: Kamoa-Kakula 2023 PFS Unit Operating Costs

| $/lb. Payable Copper | |||

| 2023-2024 | 2025-2029 | First 10 Years | |

| Mining | 0.41 | 0.44 | 0.47 |

| Processing | 0.16 | 0.15 | 0.16 |

| Smelter | – | 0.16 | 0.13 |

| Logistics | 0.51 | 0.24 | 0.29 |

| Treatment, Refining, Smelter charges | 0.24 | 0.12 | 0.14 |

| General & Administration | 0.13 | 0.10 | 0.09 |

| Sulphuric Acid Credits1 | – | -0.07 | -0.06 |

| C1 Cash Cost | 1.45 | 1.15 | 1.22 |

| Royalties & Export Tax | 0.29 | 0.21 | 0.22 |

| Total Cash Cost | 1.74 | 1.36 | 1.44 |

Note: C1 cash costs in this table include the impact of accounting adjustments related to the addition or depletion of the surface stockpiles where applicable.

- Assumes a sulphuric acid price of $150 per tonne.

Table 4: Kamoa-Kakula 2023 PFS Revenue and Operating Costs

| $M | $/t Milled | |||

| LOM | 2023-2025 | 2025-2029 | First 10 Years | |

| Revenue | ||||

| Copper Production | 131,069 | 411 | 379 | 350 |

| Acid Production | 2,618 | – | 7 | 6 |

| Gross Sales Revenue | 133,687 | 411 | 386 | 356 |

| Less: Realization Costs | ||||

| Logistics | 9,053 | 55 | 24 | 27 |

| TC, RC, Smelter Charges | 4,719 | 25 | 12 | 13 |

| Royalties & Export Tax | 7,417 | 31 | 21 | 21 |

| Total Realization Costs | 21,189 | 111 | 57 | 60 |

| Net Sales Revenue | 112,498 | 300 | 329 | 296 |

| Site Operating Costs | ||||

| Mining | 19,380 | 48 | 40 | 42 |

| Processing | 7,167 | 17 | 15 | 15 |

| Smelter | 5,298 | – | 16 | 12 |

| G&A | 2,800 | 14 | 10 | 9 |

| Total | 34,644 | 79 | 81 | 78 |

| EBITDA | 77,854 | 221 | 248 | 218 |

| EBITDA Margin | 58.2% | 53.9% | 64.3% | 61.3% |

Note: The copper price used in the economic analysis is $3.80/lb. in 2023, $3.90/lb. in 2024, $4.00/lb. in 2025, $4.00/lb. in 2026 and a long-term copper price of $3.70/lb. from 2027 onwards.

Table 5: Kamoa-Kakula 2023 PFS Summary of Capital Expenditure by Area

| Capital Expenditure | Phase 3 | Phase 4 | Sustaining | Total |

| ($M) | ($M) | ($M) | ($M) | |

| Mining | 607 | 750 | 3,984 | 5,341 |

| Underground Mining | 543 | 684 | 2,747 | 3,974 |

| Mining Mobile Equipment | 63 | 66 | 1,238 | 1,367 |

| Power & Smelter | 990 | 134 | 165 | 1,289 |

| Smelter | 906 | – | 165 | 1,071 |

| Power Infrastructure | 84 | 134 | – | 218 |

| Concentrator & Tailings | 320 | 238 | 597 | 1,154 |

| Process Plant | 262 | 238 | 193 | 693 |

| Tailings | 57 | – | 404 | 461 |

| Infrastructure | 662 | 182 | 220 | 1,064 |

| General Surface Infrastructure | 662 | 98 | 150 | 910 |

| Rail Spur | – | 84 | 70 | 154 |

| Indirects | 302 | 185 | 340 | 826 |

| EPCM | 127 | 141 | 5 | 273 |

| Owners Cost | 83 | – | 15 | 98 |

| Customs Duties | 92 | 44 | 175 | 311 |

| Closure | – | – | 145 | 145 |

| Capital Expenditure Before Contingency | 2,880 | 1,488 | 5,306 | 9,674 |

| Contingency | 157 | 65 | 277 | 499 |

| Capital Expenditure After Contingency | 3,037 | 1,553 | 5,583 | 10,173 |

Note: The remaining Phase 3 capital cost of $3,037 million includes approximately $2,529 million that will be spent in 2023 and 2024, before the commissioning of the Phase 3 concentrator and other infrastructure, and an additional $508 million incurred in 2025 and 2026 that is related to the completion of the ramp-up of the underground mining operations to sustain a total production rate of 14.2 Mtpa.

Table 6: Kamoa-Kakula 2023 PFS Net Present Value at Base Case and Spot Prices

| After-tax Net Present Value (NPV) | Discount Rate

(%) |

Base Case Prices (1)

($M) |

Spot Prices (2)

($M) |

| Undiscounted | 47,969 | 59,854 | |

| 4.0% | 28,966 | 36,071 | |

| 6.0% | 23,272 | 28,970 | |

| 8.0% | 19,062 | 23,729 | |

| 10.0% | 15,884 | 19,780 | |

| 12.0% | 13,438 | 16,746 |

- Base case copper price assumptions are as follows: $3.80/lb. in 2023, $3.90/lb. in 2024, $4.00/lb. in 2025, $4.00/lb. in 2026 and a long-term copper price of $3.70/lb. from 2027 onwards.

- Spot copper price as at January 27, 2023, is US$4.24/lb. copper, which is assumed over the life of mine.

Table 7: Kamoa-Kakula 2023 PFS Copper Price Sensitivity

| After-Tax NPV ($M) | Long-Term Copper Price – $/lb. | ||||||||

| Discount Rate | 2.00 | 3.00 | 3.50 | 3.70 | 4.00 | 4.25 | 4.50 | 5.00 | 6.00 |

| Undiscounted | 12,760 | 33,732 | 43,902 | 47,969 | 54,069 | 59,153 | 64,237 | 72,562 | 87,982 |

| 4.0% | 9,004 | 20,846 | 26,646 | 28,966 | 32,446 | 35,346 | 38,246 | 42,990 | 51,776 |

| 6.0% | 7,734 | 16,940 | 21,463 | 23,272 | 25,986 | 28,248 | 30,509 | 34,211 | 41,069 |

| 8.0% | 6,733 | 14,032 | 17,625 | 19,062 | 21,218 | 23,015 | 24,811 | 27,756 | 33,213 |

| 10.0% | 5,934 | 11,821 | 14,723 | 15,884 | 17,626 | 19,077 | 20,528 | 22,910 | 27,328 |

| 12.0% | 5,285 | 10,107 | 12,486 | 13,438 | 14,865 | 16,055 | 17,244 | 19,201 | 22,833 |

| 15.0% | 4,519 | 8,183 | 9,992 | 10,715 | 11,800 | 12,704 | 13,609 | 15,101 | 17,875 |

- Note: The copper price used in the economic analysis is $3.80/lb. in 2023, $3.90/lb. in 2024, $4.00/lb. in 2025, $4.00/lb. in 2026 and a long-term copper price of $3.70/lb. from 2027 onwards.

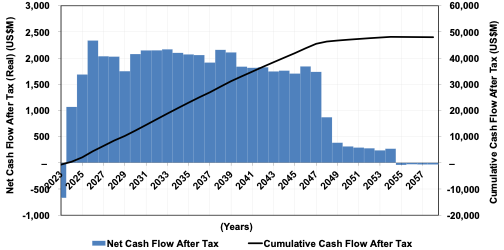

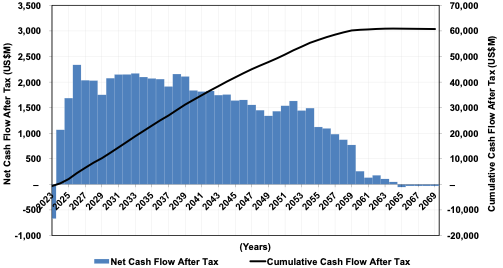

Figure 14: Kamoa-Kakula 2023 PFS Projected Cash Flow (After-Tax)

Figure by OreWin, 2023.

Kamoa-Kakula 2022 Mineral Resource

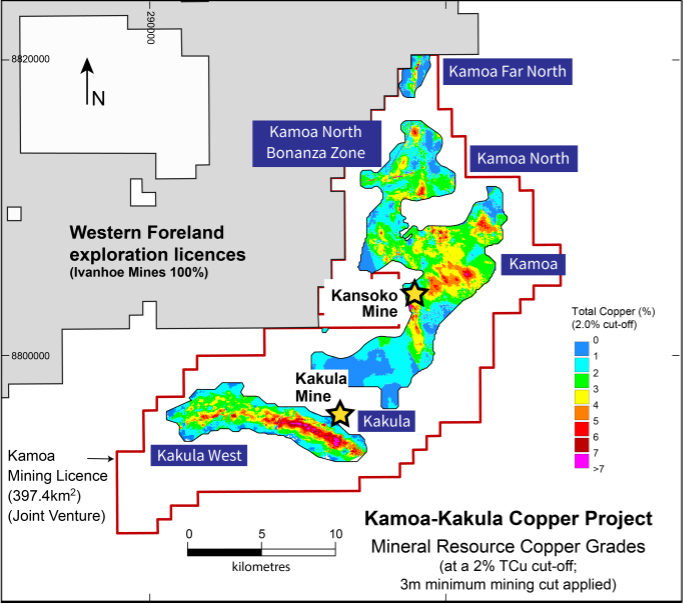

The Kamoa-Kakula 2022 Mineral Resource estimate was prepared by George Gilchrist, Ivanhoe Mines’ Vice President, Resources, under the direction of Jeremy Witley, Pr.Sci.Nat, of the MSA Group of Johannesburg, South Africa, and is reported per the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. Mr. Witley is a Qualified Person for Mineral Resources. The effective date of the Mineral Resources is December 31, 2022, and the cut-off date for drill data is December 13, 2022, for the Kakula estimate and January 20, 2020, for the Kamoa estimate.

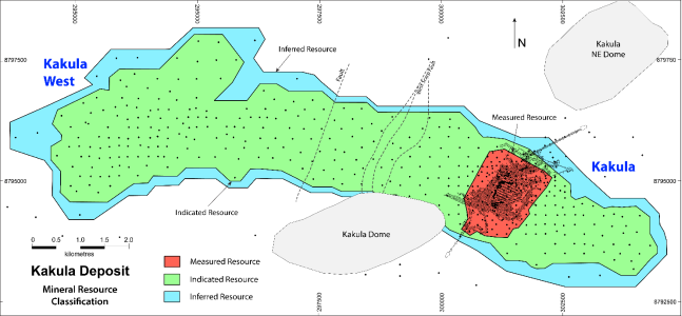

Ongoing infill drilling from the surface ahead of mining, and mapping and sampling of underground exposures have refined the geological interpretation and increased confidence in the geological and grade continuity in this area, allowing for the definition of a Measured Resource at Kakula for the first time, see Figure 15. The Measured and Indicated Mineral Resource, as well as the Inferred Mineral Resource for the Kamoa-Kakula Copper Complex are shown in Table 8.

Figure 15: Plan view of the Kakula Mineral Resource by classification

Existing underground development as at December 2022.

Figure 16: Plan View of the Kakula Underground Mine Layout, showing underground infrastructure and unexploited reserves (in red)

Table 8: Kamoa-Kakula Mineral Resources by deposit (at 1% total copper cut-off grade)

| Deposit | Category | Tonnes (millions) | Area

(Sq. km) |

Copper Grade (%) | Contained Copper (kt) | Contained Copper (billion lbs.) |

| Kamoa | Measured | – | – | – | – | – |

| Indicated | 760 | 55.2 | 2.73 | 20,800 | 45.8 | |

| Inferred | 235 | 21.8 | 1.70 | 4,010 | 8.8 | |

| Kakula | Measured | 90 | 2.2 | 3.13 | 2,810 | 6.2 |

| Indicated | 540 | 21.7 | 2.65 | 14,300 | 31.6 | |

| Inferred | 75 | 5.5 | 1.60 | 1,200 | 2.6 | |

| Total Project | Measured | 90 | 2.2 | 3.13 | 2,810 | 6.2 |

| Indicated | 1,300 | 76.9 | 2.70 | 35,100 | 77.4 | |

| Inferred | 310 | 27.3 | 1.68 | 5,210 | 11.5 |

Notes to accompany the total, combined Kamoa-Kakula Mineral Resource table:

- Ivanhoe’s Vice President, Resources, George Gilchrist, Professional Natural Scientist (Pr. Sci. Nat) with the South African Council for Natural Scientific Professions (SACNASP), estimated the Mineral Resources under the supervision of Jeremy Witley, Pr.Sci.Nat SACNASP, FGSSA. The cut-off date for drill data at Kamoa is 20 January 2020. The cut-off date for the drill data at Kakula is 20 July 2022, with the assay table updated as of 13 December 2022. On 31 December 2022, the Mineral Resource was depleted to account for annual production; the Mineral Resource has an effective date of 31 December 2022. Mineral Resources are reported using the CIM 2014 Definition Standards for Mineral Resources and Mineral Reserves. Mineral Resources are reported on a 100% basis. Ivanhoe holds an indirect 39.6% interest in the Project. Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported for Kamoa using a total copper (TCu) cut-off grade of 1% TCu and a minimum vertical thickness of 3m. There are reasonable prospects for eventual economic extraction under the following assumptions: copper price $4.00/lb; employment of underground mechanized drift-and-fill mining methods; copper blister and concentrates will be produced and sold; average metallurgical recovery is 87.5%; mining costs are assumed to be $38/t; concentrator, tailings treatment, and general and administrative costs are assumed to be $15/t; smelter, refining and transport costs are assumed to be $13.5/t of ore at the cut-off grade; royalty of 3.5%, export tax of 1% and concentrate tax of $100/t concentrate.

- Mineral Resources are reported for Kakula using a total copper (TCu) cut-off grade of 1% TCu and a minimum vertical thickness of 3 m. There are reasonable prospects for eventual economic extraction under the following assumptions: copper price $4.00/lb; employment of underground mechanized drift-and-fill mining methods, and that copper blister and concentrates will be produced and sold; average metallurgical recovery is 85.5%; mining costs are assumed to be $38/t; concentrator, tailings treatment, and general and administrative costs are assumed to be $15/t; smelter, refining and transport costs are assumed to be $9.5/t of ore at the cut-off grade; royalty of 3.5%, export tax of 1% and concentrate tax of $100/t concentrate.

- Reported Mineral Resources contain no allowances for hanging wall or footwall contact boundary loss and dilution. No mining recovery has been applied.

- Approximate drill hole spacings are 800m for Inferred Mineral Resources, 400m for Indicated Mineral Resources and 100m or underground exposure for Measured Mineral Resources.

- Rounding as required by reporting guidelines may result in apparent summation differences between tonnes, grade and contained metal content.

Figure 17: Map of the Kamoa-Kakula mining licence showing the Kakula and Kansoko mining areas, as well as Kakula West, Kamoa North, Kamoa Far North, Kamoa North Bonanza Zone and a portion of Ivanhoe’s adjacent, 90 to 100%-owned Western Foreland exploration licences

Kamoa-Kakula 2023 PFS Mineral Reserve

The Kamoa-Kakula 2023 PFS Mineral Reserve has been estimated by Qualified Person Curtis Smith AusIMM(CP), Principal Mining Engineer, OreWin Pty Ltd, using the 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves to conform to the Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects. The total Mineral Reserve for the Kamoa-Kakula Copper Complex is shown in Table 9. The Mineral Reserve is based on the January 2020 Mineral Resource. The Mineral Reserve is entirely a Probable Mineral Reserve that was converted from Indicated Mineral Resources. The effective date of the Mineral Reserve statement is December 31, 2022. The Kamoa 2022 Mineral Resource estimate effective date December 31, 2022, was not completed in time to allow it to be included in the Kamoa-Kakula 2023 PFS.

Table 9: Kamoa-Kakula 2023 PFS Mineral Reserves by Deposit

| Classification | Ore (Mt) | Copper (%) | Contained Copper (Mlb) | Contained Copper (kt) |

| Proven Mineral Reserve | – | – | – | – |

| Probable Mineral Reserve | 472 | 3.94 | 41,055 | 18,622 |

| – Kakula | 138 | 4.79 | 14,580 | 6,613 |

| – Kakula West | 90 | 3.87 | 7,647 | 3,469 |

| – Kamoa 1 | 121 | 3.74 | 9,963 | 4,519 |

| – Kansoko Sud | 38 | 3.70 | 3,088 | 1,401 |

| – Kamoa 2 | 86 | 3.05 | 5,778 | 2,621 |

| Total Mineral Reserve | 472 | 3.94 | 41,055 | 18,622 |

Notes to accompany Kamoa-Kakula 2023 PFS Mineral Reserve table

- The long-term copper price used for calculating the financial analysis is $3.70/lb. The analysis has been calculated with assumptions for an on-site smelter and excess concentrate sold to external smelters. Realization costs include refining and treatment charges, deductions and payment terms, blister and concentrate transport, metallurgical recoveries, and royalties.

- The increase in Mineral Reserves can be attributed to an increased height (7.5 m) of the second lift at Kakula, the redefining of mine boundaries at Kamoa, and the addition of Kakula West and Kamoa 2.

- For mine planning, the copper price used to calculate block model Net Smelter Return (NSRs) is $3.10/lb.

- The effective date of the Mineral Reserve statement is December 31, 2022. The Kamoa 2022 Mineral Resource estimate, effective date December 31, 2022, was not completed in time to allow it to be included in the Kamoa-Kakula 2023 PFS

- An elevated cut-off of $100.00/t NSR was used to define the stopping blocks. A marginal cut-off of $80.00/t NSR was used to define ore and waste.

- Indicated Mineral Resources were used to report Probable Mineral Reserves from the January 2020 Mineral Resource.

- Tonnage and grade estimates include dilution and recovery allowances.

- The Mineral Reserves reported above are not additive to the Mineral Resources.

Figure 18: Site layout of the Kamoa-Kakula Copper Complex showing scope areas within the of 2023 PFS and 2023 PEA

SUMMARY OF THE KEY PROJECTIONS OF THE KAMOA-KAKULA 2023 PEA

- Life-of-mine extension case shows the potential to maintain the production rate at up to 19.2 Mtpa for an additional 9 years beyond the 33 years in the Kamoa-Kakula 2023 PFS.

- Sequential ramp-up of four new underground mines in the Kamoa area (called Kamoa 3, 4, 5 and 6) providing an additional 181.2 Mt of feed to the Kamoa and Kakula concentrators at an average grade of 3.1% copper, producing an additional 4.8 Mt of contained copper in concentrate.

- After-tax NPV, at an 8% discount rate, of $2 billion and mine life of 42 years.

The Kamoa-Kakula 2023 PEA is preliminary and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would allow them to be categorized as Mineral Reserves – and there is no certainty that the results will be realized. Mineral Resources do not have demonstrated economic viability and are not Mineral Reserves.

Key results of the Kamoa-Kakula 2023 PEA are summarized in Tables 10, 11 and 12 and Figure 19.

Table 10: Kamoa-Kakula2023 PEA summary of results

| Item | Unit | Total |

| Total Processed (Life of Mine) | ||

| Quantity Milled | kt | 657,428 |

| Copper Feed Grade | % | 3.70 |

| Total Concentrate Produced (Life of Mine) | ||

| Copper Concentrate Produced | kt (dry) | 50,761 |

| Copper Recovery | % | 86.45 |

| Copper Concentrate Grade | % | 41.45 |

| Contained Metal in Conc. | Mlb | 46,384 |

| Contained Metal in Conc. | kt | 21,040 |

| Key Financial Results | ||

| Remaining Phase 3 Capital Costs | $M | 3,037 |

| Phase 4 Capital Costs Capital Costs | $M | 1,553 |

| Sustaining Capital Costs | $M | 8,858 |

| LOM Avg. C1 Cash Cost | $/lb. Payable Cu | 1.32 |

| LOM Avg. Total Cash Costs | $/lb. Payable Cu | 1.53 |

| LOM Avg. Site Operating Costs | $/t Milled | 70.57 |

| After-Tax NPV8% | $M | 20,224 |

| Project Life | Years | 42 |

Note: the copper price used in the economic analysis is $3.80/lb. in 2023, $3.90/lb. in 2024, $4.00/lb. in 2025, $4.00/lb. in 2026 and a long-term copper price of $3.70/lb. from 2027 onwards.

Table 11: Kamoa-Kakula 2023 PEA financial results at base case and spot prices

| After-tax Net present value (NPV) | Discount Rate

(%) |

Base Case Prices (1)

($M) |

Spot Prices (2)

($M) |

| Undiscounted | 60,760 | 76,343 | |

| 4.0% | 32,708 | 40,892 | |

| 6.0% | 25,342 | 31,638 | |

| 8.0% | 20,224 | 25,228 | |

| 10.0% | 16,544 | 20,634 | |

| 12.0% | 13,818 | 17,238 |

- Base case copper price assumptions are as follows: $3.80/lb. in 2023, $3.90/lb. in 2024, $4.00/lb. in 2025, $4.00/lb. in 2026 and a long-term copper price of $3.70/lb. from 2027 onwards.

- Spot copper price as at January 27, 2023, is US$4.24/lb. copper, which is assumed over the life of the mine.

Figure 19: Kamoa-Kakula 2023 PEA projected annual and cumulative cashflow

Figure by OreWin, 2023.

Table 12: Kamoa-Kakula 2023 PEA copper price sensitivity

| After-Tax NPV ($M) | Long-Term Copper Price – $/lb. | ||||||||

| Discount Rate | 2.00 | 3.00 | 3.50 | 3.70 | 4.00 | 4.25 | 4.50 | 5.00 | 6.00 |

| Undiscounted | 13,765 | 41,731 | 55,323 | 60,760 | 68,915 | 75,710 | 82,506 | 93,703 | 114,500 |

| 4.0% | 9,315 | 23,190 | 29,989 | 32,708 | 36,787 | 40,187 | 43,586 | 49,149 | 59,451 |

| 6.0% | 7,902 | 18,235 | 23,312 | 25,342 | 28,388 | 30,927 | 33,465 | 37,616 | 45,301 |

| 8.0% | 6,822 | 14,756 | 18,661 | 20,224 | 22,567 | 24,520 | 26,472 | 29,667 | 35,583 |

| 10.0% | 5,980 | 12,231 | 15,312 | 16,544 | 18,393 | 19,934 | 21,474 | 23,998 | 28,675 |

| 12.0% | 5,308 | 10,342 | 12,825 | 13,818 | 15,308 | 16,549 | 17,791 | 19,829 | 23,609 |

| 15.0% | 4,526 | 8,287 | 10,143 | 10,885 | 11,998 | 12,926 | 13,854 | 15,383 | 18,223 |

Note: The copper price used in the economic analysis is $3.80/lb. in 2023, $3.90/lb. in 2024, $4.00/lb. in 2025, $4.00/lb. in 2026 and a long-term copper price of $3.70/lb. from 2027 onwards.

Non-GAAP Financial Performance Measures

Cash costs (C1) and cash costs (C1) per pound are non-GAAP financial measures. These are disclosed to enable investors to better understand the performance of the Kamoa-Kakula Copper Complex in comparison to other copper producers who present results on a similar basis. Cash costs (C1) are prepared on a basis consistent with the industry standard definitions by Wood Mackenzie cost guidelines but are not measures recognized under IFRS.

Below is a reconciliation of Kamoa-Kakula’s historical cost of sales to cash costs (C1), including on a per-pound basis:

| Kamoa-Kakula Three months

ended September 30, |

Kamoa-Kakula Nine months

ended September 30, |

|

| 2022 | 2022 | |

| $’000 | $’000 | |

| Cost of sales | 216,233 | 556,715 |

| Logistics, treatment and refining charges | 141,126 | 303,638 |

| General and administrative expenditure | 21,476 | 61,209 |

| Royalties and production taxes | (58,160) | (142,387) |

| Depreciation | (31,023) | (78,716) |

| Movement in finished goods inventory | 7,451 | 7,999 |

| General and administrative expenses of other group entities | 1,224 | (1,078) |

| C1 cash costs | 298,327 | 707,380 |

| Cost of sales per pound of payable copper sold ($ per lb.) | 1.05 | 1.09 |

| C1 cash costs per pound of payable copper produced ($ per lb.) | 1.43 | 1.38 |

All the figures above are on a 100% basis. See the Management’s Discussion and Analysis for the three and nine months ended September 30, 2022, for further discussion of non-GAAP measures.

Qualified persons

The following companies have undertaken work in preparation for the Kamoa-Kakula 2023 IDP which includes the Kamoa-Kakula 2023 PFS and the Kamoa-Kakula 2023 PEA:

- OreWin Pty Ltd. of Adelaide, Australia – Overall report preparation, Mining and Mineral Reserves, mining, logistics, and economic analysis.

- China Nerin Engineering Co. Ltd. of Jiangxi, China – Smelter design.

- DRA Global of Johannesburg, South Africa – Mine surface infrastructure and metallurgical processing.

- Epoch Resources of Johannesburg, South Africa – Tailings Storage Facility design.

- Golder Associates Africa of Midrand, South Africa – Hydrology models and recommendations.

- Outotec Oyj of Helsinki, Finland – Smelter technology.

- Paterson and Cooke of Cape Town, South Africa – Paste Backfill Plant design and Surface / Underground paste distribution system.

- SRK Consulting Inc. of Cape Town, South Africa – Mine geotechnical recommendations.

- MSA Group of Johannesburg, South Africa – Mineral Resource estimation.

The independent Qualified Persons responsible for preparing the Kamoa-Kakula 2023 PFS, and Kamoa-Kakula 2023 PEA, on which the technical report will be based, are Bernard Peters (OreWin); Jeremy Witley (MSA Group); Curtis Smith (OreWin); William Joughin (SRK); Marius Phillips (DRA Global); Alwyn Scholz (DRA Global); and Guy Wiid (Epoch). Each Qualified Person has reviewed and approved the information in this news release relevant to the portion of the Kamoa-Kakula 2023 PFS and Kamoa-Kakula 2023 PEA for which they are responsible.

Disclosures of a scientific or technical nature regarding the Kamoa-Kakula stockpiles in this news release have been reviewed and approved by George Gilchrist, who is considered, by virtue of his education, experience and professional association, a Qualified Person under the terms of NI 43-101. Mr. Gilchrist is not considered independent under NI 43- 101 as he is the Vice President, Resources, at Ivanhoe Mines. Mr. Gilchrist has verified the technical data regarding the Kamoa-Kakula stockpiles disclosed in this news release.

Wood Mackenzie of Edinburgh, Scotland, provided data based on public disclosure of comparable copper projects for the compilation of certain figures used in this release; however, Wood Mackenzie did not review the Kamoa-Kakula 2023 PFS or the Kamoa-Kakula 2023 PEA.

Data verification and quality control and assurance

Amec Foster Wheeler, a Wood company (Wood), reviewed the sample chain of custody, quality assurance and control procedures, and qualifications of analytical laboratories. Wood believes that the procedures and QA/QC control are acceptable to support Mineral Resource estimation. Wood also audited the assay database, core logging, and geological interpretations on several occasions between 2009 and 2020, and has found no material issues with the data because of these audits.

In the opinion of the Wood Qualified Persons, the data verification programs are undertaken on the data collected from the Kamoa-Kakula Copper Complex to support the geological interpretations. The analytical and database quality and the data collected can support Mineral Resource estimation.

Ivanhoe Mines maintains a comprehensive chain of custody and QA/QC program on assays from its Kamoa Kakula Copper Project. The half-sawn core is processed at its on-site preparation laboratory in Kamoa, prepared samples then are shipped by secure courier to Bureau Veritas Minerals (BVM) Laboratories in Australia, an ISO17025 accredited facility. Copper assays are determined at BVM by mixed-acid digestion with an ICP finish. Industry-standard certified reference materials and blanks are inserted into the sample stream before dispatch to BVM.

For detailed information about assay methods and data verification measures used to support the scientific and technical information, please refer to the Kamoa-Kakula 2020 Resource Update technical report dated March 27, 2020, available on the SEDAR profile of Ivanhoe Mines at www.sedar.com or under technical reports on the Ivanhoe Mines website at www.ivanhoemines.com.

About Ivanhoe Mines

Ivanhoe Mines is a Canadian mining company focused on advancing its three principal projects in Southern Africa; the expansion of the Kamoa-Kakula Copper Complex in the DRC, the construction of the tier-one Platreef palladium-rhodium-platinum-nickel-copper-gold project in South Africa; and the restart of the historic ultra-high-grade Kipushi zinc-copper-germanium-silver mine, also in the DRC.

Ivanhoe Mines is also exploring for new copper discoveries across its circa 2,400km2 of 90-100% owned exploration licences in the Western Foreland, which are located adjacent to, or in close proximity to, the Kamoa-Kakula Copper Complex in the DRC.

Information contact

Follow Robert Friedland (@robert_ivanhoe) and Ivanhoe Mines (@IvanhoeMines_) on Twitter.

Investors

Vancouver: Matthew Keevil +1.604.558.1034

London: Tommy Horton +44 7866 913 207

Media

Tanya Todd +1.604.331.9834

Website www.ivanhoemines.com

Forward-looking statements

Certain statements in this release constitute “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. Such statements and information involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the company, its projects, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. Such statements can be identified using words such as “may”, “would”, “could”, “will”, “intend”, “expect”, “believe”, “plan”, “anticipate”, “estimate”, “scheduled”, “forecast”, “predict” and other similar terminology, or state that certain actions, events, or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These statements reflect the company’s current expectations regarding future events, performance and results and speak only as of the date of this release.